Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

“No man's life, liberty, or property are safe while the legislature is in session” ― Gideon J. Tucker

The French proverb, “The more things change the more they remain the same,” applies with special force in Connecticut politics. The dominant Democrat Party in the state may wish people to believe they are agents of change, but in truth this party, lately crowded with neo-progressives, has been in power for at least 30 years, perhaps more. And the Democrat party machine has ruled the urban politisphere in the state for 50 years and more – with predicable results.

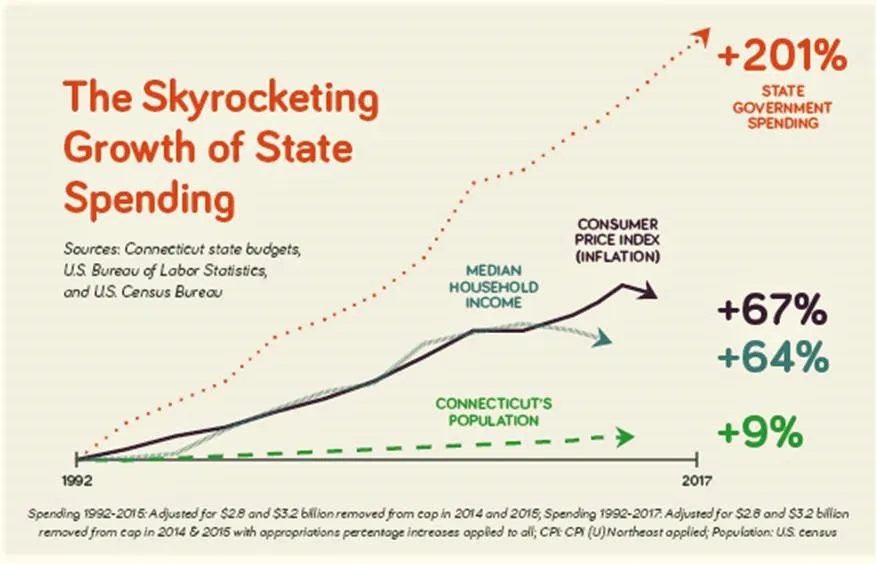

In 2017, the balance of power in the General Assembly was such that the legislature, under pressure from Republicans, seriously addressed for the first time in decades the state’s spending addiction. So called “guardrails” were established so that Connecticut might address a persistent and longstanding problem. For about (half a century), Connecticut’s expenditures had exceeded its tax acquisitions, and the state sank heavily in debt to the tune presently of $28,967,901,000.

Guardrails, the Hartford Courant tells us, is state Capital “nomenclature for a series of budgetary caps [passed in 2017] that have helped restore the state to fiscal health through spending, volatility and revenue restrictions”

Since the state’s political house is made of glass, rating agencies noticed Connecticut’s mounting debt and downgraded the state – which, in turn, made the borrowing of money to pay for Connecticut’s extravagant spending more expensive. Governments, state and national, borrow money to pay for expense in lieu of tax increases, frowned upon by the party in power. More favorably situated, the federal government both borrows money and prints money to pay for expenses, both of which cause inflation – a drop in the monetary worth of the dollar.

There are various kinds of taxes, some hidden, some not. Inflation is a hidden tax, insidious because most people do not notice they are spending more dollars for items owing to the devaluation of the dollar. Many people do not notice that that business costs, including taxes, are recovered through increases in the price of goods and services. Businesses are tax collectors, not taxpayers. Borrowing by the state to cover politicians who lack the courage to raise taxes to balance expenses is a useful political sleight of hand deployed, in Lincoln’s words, to “fool most of the people most of the time.”

State debt occurs when expenditures exceed tax collections. We all remember Wilkins Micawber in Charles Dickens’ David Copperfield, hauled off to prison for non-payment of debt, exclaiming sorrowfully, “Annual income twenty pounds, annual expenditure nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty-pound ought and six, result misery.”

Debtor prisons have been abolished. Had they not been abolished, we would be voting for or against many of our politicians housed in the hoosegows owing to their improvident spending – that is, spending that exceeds the state’s revenue intake.

No one on the right side of Connecticut’s political aisle was surprised to learn that neo-progressive leaders in the General Assembly will soon propose revisions in the state’s guardrail legislation. The neo-progressive hope is to divert from its intended purpose – the use of surplus dollars to pay down accumulated outstanding debt -- a portion of Connecticut’s swollen surplus. The diversion is necessary because neo-progressive legislators lack the courage to raise taxes to cover current and anticipated increases in spending.

Guardrail surpluses, originally intended to defray and pay down the costs of state worker pension debt, will in the future be used, some Republican legislators suspect, to finance future costs that had in the past produced a gargantuan debt, highest in the nation, unattended for decades.

What Connecticut needs, of course, are restraints on spending – because, as everyone knows, spending in excess of tax financing produces future debt.

See Mr. Micawber above.

Well said, Don, thank you.

I can’t lay the blame solely on neo-progressive legislators.

Someone put them there.

An all too-comfortable, un-responsible constituency, pleased with their enlightened perspective and their proxy representatives.

The culture needs a comeuppance.

Just sayin