Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

The Micawber principle states: “Annual income twenty pounds, annual expenditure nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds nought and six, result misery.”

The inescapable golden rule of budgeting – announced dramatically by Mr. Micawber in Charles Dickens’ David Copperfield is this: When income exceeds expenditures by an infinitesimal amount, you are blessed with happiness. When, on the other hand, your expenditures exceed your income, you quickly arrive at the gates of “misery.” And in Dickens’ day, misery involved spending a good deal of time in debtors’ prison, the fate of Dickens’ own father.

Nearly everyone in Connecticut who does not draw a salary from taxpayer provided funds, regarded as infinite by neo-progressive spendthrift politicians, tends to abide, if grudgingly, by the golden rule, even though debtors’ prisons have long been abolished.

In the political realm, exceptions to the rule are the rule. Slithery politicians have easily carved routes around the golden rule, otherwise neither the nation nor a majority of states – Connecticut is one of them – would be carrying such burdensome and inflationary loads of debt.

The ability of a country to pay down its national debt is best calculated by comparing the ratio of a country’s debt to its Gross Domestic Product (GDP), the country’s total economic output. “The U.S. debt to GDP ratio surpassed 100% in 2013 when both debt and GDP were approximately 16.7 trillion,” according to the U.S. Treasury Department’s fiscal data. In 1981, the ratio of debt to GDP was 32%. The ratio of the national debt to GDP in 2020 was 123%. However you mash the numbers, Micawber would gag at the accumulation of debt in only 13 years.

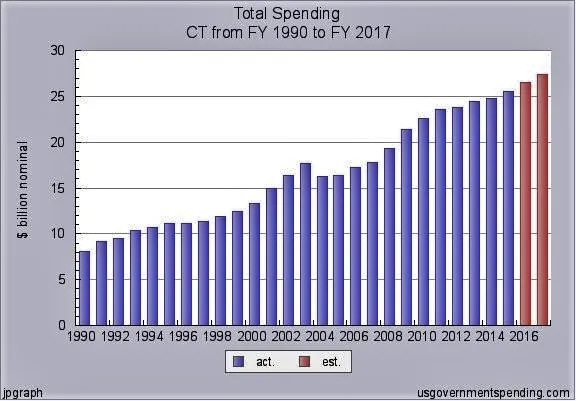

A sensible law preventing state debt might run as follows: The ratio of debt to GSP, gross state product, shall remain at zero until Connecticut eliminates its debt. Connecticut does have an easily circumvented spending cap, but the cap is at odds with what the state amusingly calls “fixed costs,” that is, spending that is automatically increased and cannot be reduced. Such spending is boosted automatically every year.

How have spendthrift politicians during all these years managed to escape the wrath of taxpayers and the Micawber principle?

To manage the national debt – and here the word “manage” should be taken with tons of salt – national politicians borrow money from a yet somewhat free marketplace and print money to manage indebtedness. The printing of money is the primary cause of inflation, a reduction in the value of the nation’s currency, and borrowing reduces the vigor of the private marketplace. A third option is to pass on the debt to future generations yet unborn who are therefore incapable of venting their anger at spendthrift politicians when asked to vote for politicians who are, to put the matter in the softest of terms, insensitive to their plight and indifferent to the predictable outcomes of their selfish and narrow-minded economic policies.

The hard truth is – no one is managing the national debt because no one is interested in managing spending. Spending and debt, as Micawber well knew, are casually related. When national or state expenditures exceed the ability to pay down debt, when spending exceeds either the national GDP or the value of a state’s domestic product, you get – misery, wrapped usually in verbal campaign tinfoil.

A recent hard-hitting Bloomberg op-ed amusingly warns: “With its $33.7 trillion of debt and trillion dollar budget deficit, the U.S.’s deteriorating fiscal situation is [emphasis mine] impossible to ignore. To simply balance the budget, a 29% across-the-board cut in spending would be necessary, even if the tax cuts enacted by the Trump administration are allowed to expire at the end of 2025 … what appeared to be a sustainable debt situation just a few years ago has become thoroughly unsustainable.”

But hope springs eternal. Perhaps, the op-ed writer notes, we can grow our way out of debt. In the post-World War II period, he notes, “the ratio of debt to gross domestic product was 120%. But by 1951, it had dropped to a more comfortable 73%” – largely as a result of rapid economic growth in a largely unregulated economy. Excessive regulation impedes the kind of growth spurt the nation witnessed during the post-World War II years.

So cluttered has Connecticut and the nation become with excessive regulations and tax giveaways to politically influential groups that it would be easier for a camel to pass through the eye of the needle than to hope for an even modest reduction in destructive economic tampering. And the notion that post-progressive politicians -- some of whom, President Biden comes to mind, have declared war on the internal combustion engine and the extraction of viable forms of energy lying right under our feet -- will be shocked into remedial action by Bloomberg’s warnings is far more remote than the upcoming 2024 elections.

The nation and state should remember that the easiest way for a post-progressive politician to acquire a vote is to buy one though a political largess no one can any longer afford.

Cut spending. Do it now.