Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

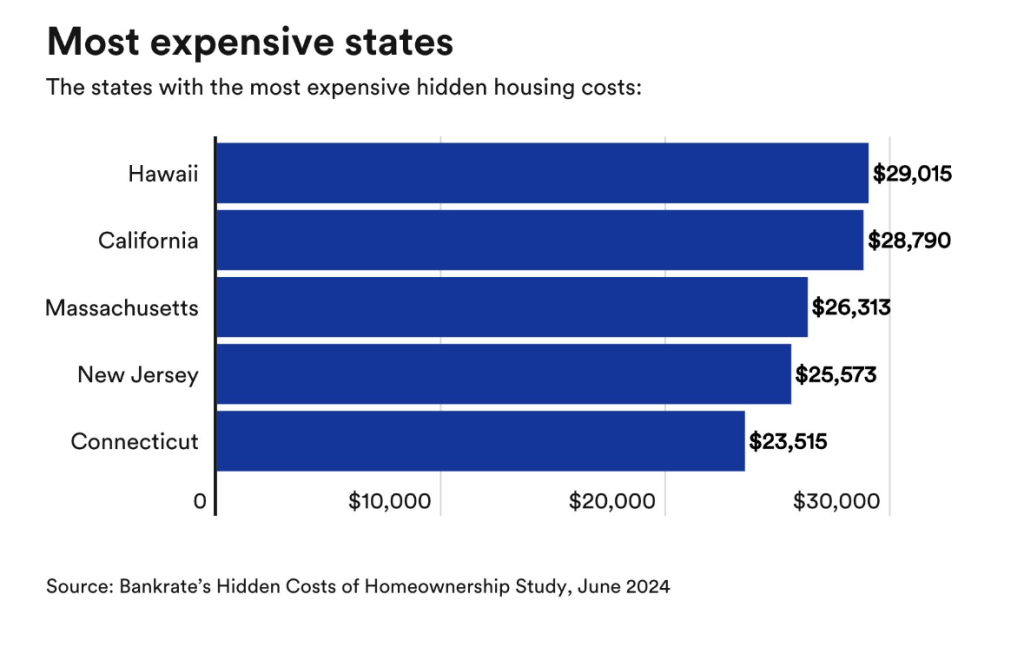

A study published by Bankrate identified Connecticut as the fifth most expensive state in the country when it comes to "hidden housing costs".

Hidden homeownership costs include the average cost of property taxes, homeowners insurance and 2% of the median sales price of single-family homes to account for maintenance and repair costs.

Energy, internet and cable bills and adjusted figures for property taxes, energy, internet and cable bills and homeowners insurance premiums for inflation are also included in the hidden cost.

Bankrate found that Connecticut homeowners pay an average of $8,073 per year in property taxes.

Then, with annual cable and internet costs averaging $1,508, annual energy bills averaging $3,367 and annual homeowners insurance averaging $1,850, Bankrate estimated homeowners in Connecticut spend an average $23,515 in hidden costs.

In 2020, the average hidden homeownership cost in Connecticut was $18,996. That means hidden costs have increased 24% over the last four years.

The average annual cost of owning and maintaining a single-family home in the U.S. is $18,118 for 2024, as compared to $14,428 in 2020.