Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

Last week's emergency session included a vote on changing the vehicle property tax included in the omnibus bill, SB 501, which passed the Connecticut House of Representatives on Thursday (6/27/24) in an 82-42 vote.

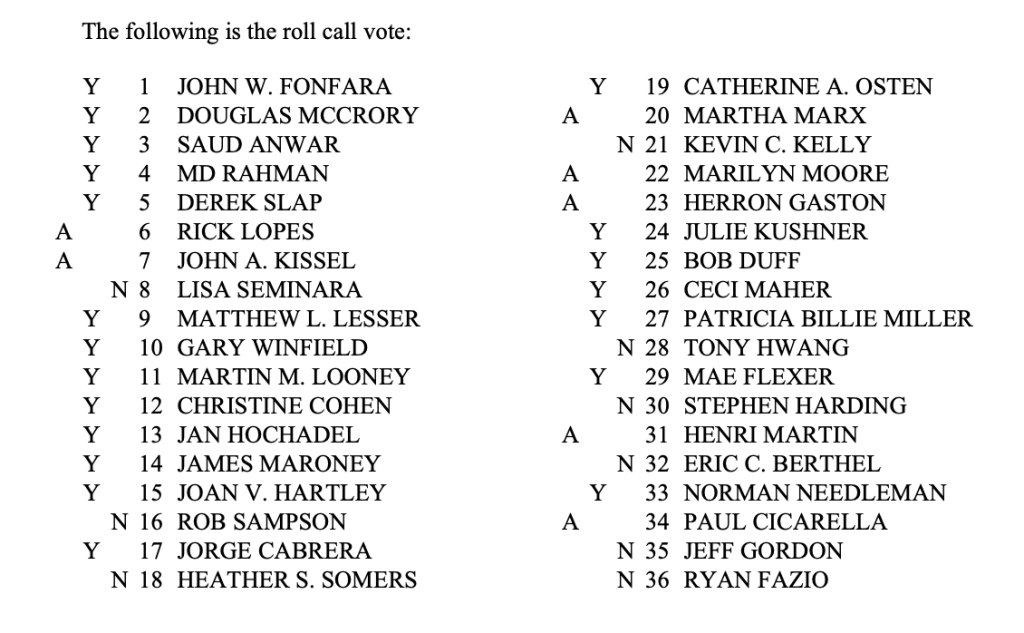

State Senate passed SB 501 a day earlier in a 20-9 vote.

The bill's full name is "An Act Concerning Motor Vehicle Assessments for Property Taxation, Innovation Banks, The Interest On Certain Tax Underpayments, The Assessment On Insurers, School Building Projects, The South Central Connecticut Regional Water Authority Charter And Certain State Historic Preservation Officer Procedures."

The bill was immediately sent to Governor Ned Lamont, who has said he will sign it.

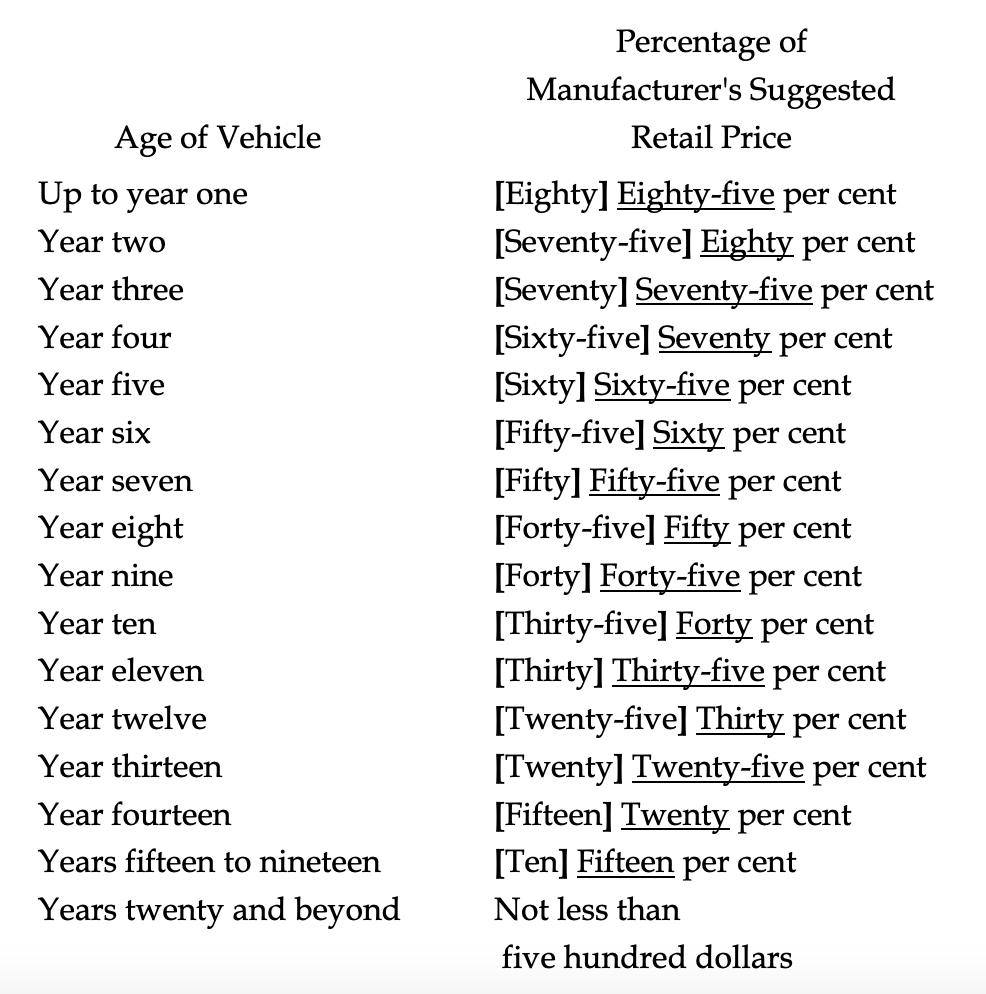

The change will increase the percentage of a vehicle's value that can be taxed based on a new, higher depreciation schedule as follows:

Democratic House Majority Leader Rep. Jason Rojas said, “there will be a one-year period in which that adjustment takes place and then I think it will even out and give some stability to the taxpayer.”

But Republican State Sen. Steve Harding acknowledged that the vote would effectively “increase motor vehicle taxes" because of the higher depreciation schedule rates.

Democratic Senate President Martin Looney also admitted that some people will see a higher car tax bill once the changes go into effect, but suggested that some could see decreases, too.

According to a report from Connecticut's Office of Legislative Research, at least 12 states have some kind of a vehicle property tax based on a vehicle's value.

Arizona, for instance, assesses cars at 60% of the manufacturer’s base retail price for new cars, and depreciates by 16.25% per year thereafter. California assesses based on market value, including any modifications, and uses an 11- year depreciation schedule, as compared to the 20-year depreciation schedule established in Connecticut.

Meanwhile, State Sen. Bob Duff, said he was "working to reduce and eventually eliminate the car tax" when he voted for the increase.