Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin

– Mark Twain

CTMirror tells us that the friends of labor have produced a bill “expanding paid sick days” in Connecticut.

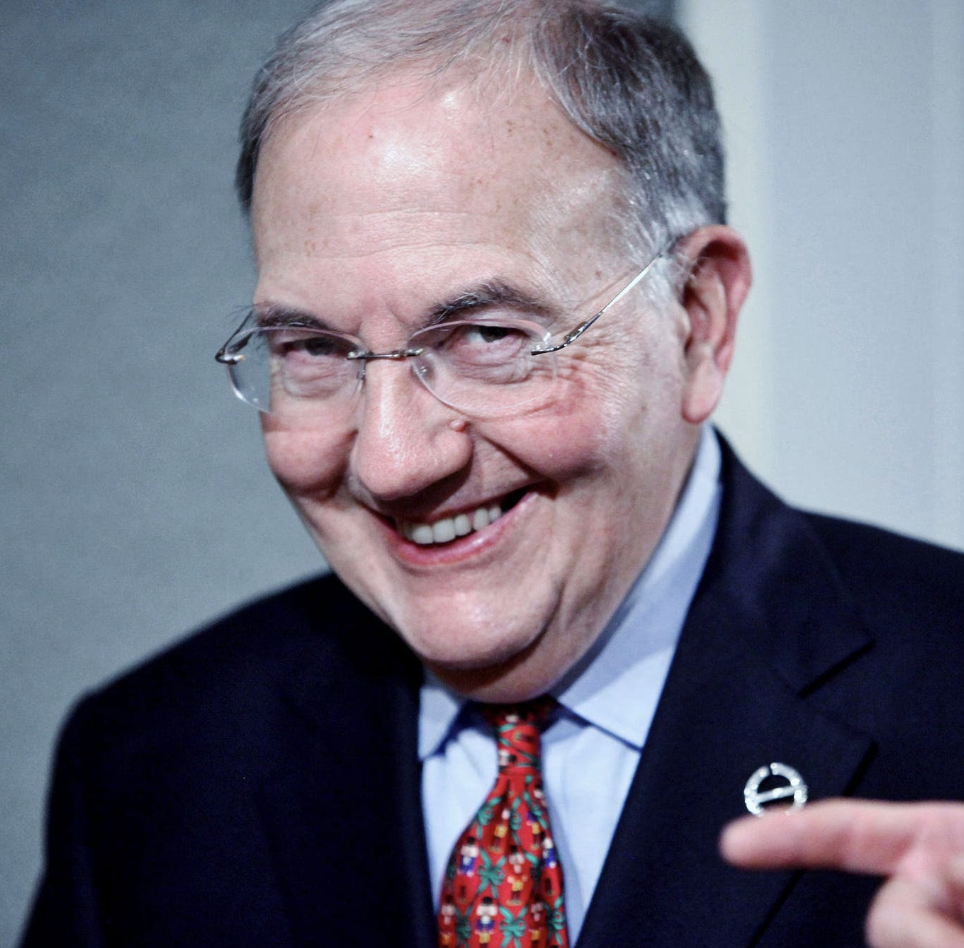

The bill, then awaiting Governor Ned Lamont’s promised signature, was greeted with loud hosannas by pro-union members of the General Assembly, most exuberantly by Connecticut’s answer to Vermont socialist U.S. Senator Bernie Sanders, state Senate President Martin M. Looney, D-New Haven.

“Sen. Julie Kushner, D-Danbury, who lobbied for the original law as a UAW [United Auto Workers Labor Union] regional executive and ran for the Senate in 2018 on a promise to expand the coverage, called the passage timely, if not overdue,” according to the CTMirror story. Looney said of the bill, “This is a landmark bill for the 2024 session, one that a number of us have worked on for a long time.”

The bill is an “expansion” of a prior bill passed in 2011 that, Kushner tells us, covered “only 12% of workers. It applied to certain employers with 50 or more workers, limited to a list of specific retail and service occupations. Seasonal workers were exempt.”

House Bill 5005 expands the coverage “in three phases by lowering the threshold for coverage from companies with 50 or more employees to those with 25 or more on Jan. 1, 2025; to 11 in 2026; and to one in 2027.”

“We now will be expanding paid sick days to every worker in Connecticut,” the co-chair of the Labor and Public Employees Committee gushed.

Under the bill’s regulatory scheme, CTMirror tells us, “employees would accrue one hour of paid time off for every 30 hours worked up to a maximum mandated benefit of 40 hours of paid time off in a year. The benefit would become available after the 120th calendar day of employment, and unused time could be carried over to the next year. There is no requirement that the time be used for sickness.”

Brushing aside Republican concerns that the bill may be crushingly burdensome on Connecticut businesses that employ one or more workers, Looney offered a short course in union history. These objections were not new, said Looney. A progressive Democrat who was elected to the House in 1980 and moved to the Senate a dozen years later.

“This is the same argument that has been made about every progressive labor reform for the past 100 years. There were those who argued that child labor shouldn’t be interfered with because it interfered with the freedom of contract between a little kid and a major corporation. And as we all know, that was bogus. The same is true, he said,” according to the CTMirror story, “of complaints that federal safety regulations and the 40-hour work week were radical and ruinous. The history of labor is one of struggle, often of violence. That’s one of the reasons why I fought a number of years ago to have a labor history curriculum for our school system. This is something that too many of our young people now take for granted.”

Here, any student well versed in the history of unions and progressive doctrine would know, Looney is concocting a word-salad that does not bear close scrutiny. Progressives in the United States have often aimed slings and arrows in the direction of Big Business. By expanding paid leave from businesses that employ 50 workers or more to businesses that employ one worker or more, Looney and Kushner are assaulting the little guy and making their bill less, not more, progressive. The progressive income tax, for instance, redistributes the burden of taxation from middle class workers to the rich who, we are constantly reminded, should learn to pay their full share of taxes.

The same progressive principle should apply to costly business regulations. The adjusted bill’s extension of paid sick time from those employing more than 50 workers to those employing more than 1 worker is a stunning violation of the progressive principle, most clearly articulated by Marx and Lenin: “From each according to his means, to each according to his need.”

The original paid sick time bill was mildly progressive because it spared small businesses a cost that is undoubtedly more burdensome to them than it would be to large corporations employing more than 50 workers.

The opposite of a progressive tax is a flat tax. The opposite of a progressive regulation, likewise, is a flatline regulation that, owing to unsupportable costs, would soon drive small businesses from an overregulated, punishing “free” market.

A student of Looney’s new “labor curriculum” would soon learn the political advantages of tax-bracket creep. The federal Income tax began as a one percent tax levied on the incomes of the very rich to pay for Civil War costs. But, over the years, the tax “trickled down” to the student’s parents, who certainly are not millionaires. Looney, it is safe to guess, pays more than 1 percent of his yearly salary in federal income taxes.

Is it not at least worth considering that progressive governance has become much greedier than it had been 43 years ago when a much younger, bright and bushy-tailed Looney first entered Connecticut’s General Assembly?

Even sharp knives become dull from overuse.

Hi Don, Thie was informative and entertaining. What a mess Connecticut is. Grass Roots East says there is no one to run for offices. The candidates should have been on board two years ago.

High five!

Linda Puetz