Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

Connecticut State Senator Matt Lesser touted a report on social media from the Institute on Taxation and Economic Policy (ITEP), which has been described as a "liberal think tank", about tax payments allegedly made by illegal immigrants.

Yes, you read that right.

Tax payments allegedly made by illegal immigrants.

If the first thing that crosses your mind after seeing this is, "gee, ITEP claims that more than a third of the tax dollars paid by illegals go towards payroll taxes... but aren't employers required to verify an employee’s eligibility to work in the U.S. using the I-9 process, which includes obtaining a valid SSN, before they start a job and before they pay taxes?", you're not alone.

But ignore that for now. You're not supposed to think about employment laws. Or about why these folks didn't follow the proper legal channels to enter the United States.

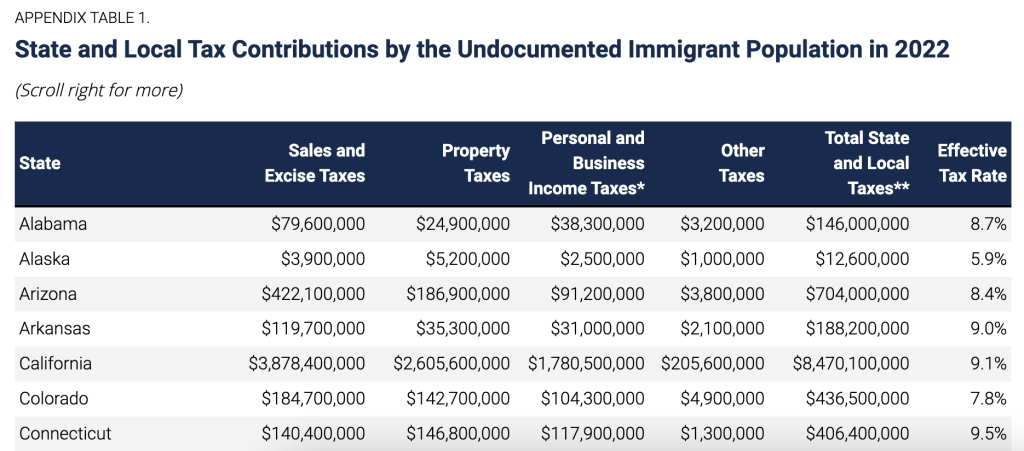

Besides, ITEP's methodology for calculating total tax contributions includes more than personal and business income taxes.

It also includes sales and excise taxes on goods and services like utilities, household products and gasoline, as well as property taxes either paid directly on their homes or indirectly when these taxes are folded into the price of monthly rent.

As a reminder Connecticut has at least four sanctuary cities, including Hartford, New Haven, New London and Windham, that have promised to ignore certain immigration laws and/or prohibit law enforcement from questioning, arresting, or detaining individuals based on perceived immigration status.

In fact, the Federation for Immigration Reform considers the whole state as a sanctuary for illegals.

The ITEP report estimates that illegal immigrants in Connecticut contributed $406,400,000 in state and local taxes. The bulk of that tax money allegedly went toward property taxes (36%), sales and excise taxes (35%), and personal and business income taxes (29%).

ITEP assumes a 60 percent contribution rate for the illegal immigrant population under the federal individual income tax. But this just an assumption based on other assumptions that are based on other assumptions. Do you really think that 60 percent of illegals are paying federal income taxes?

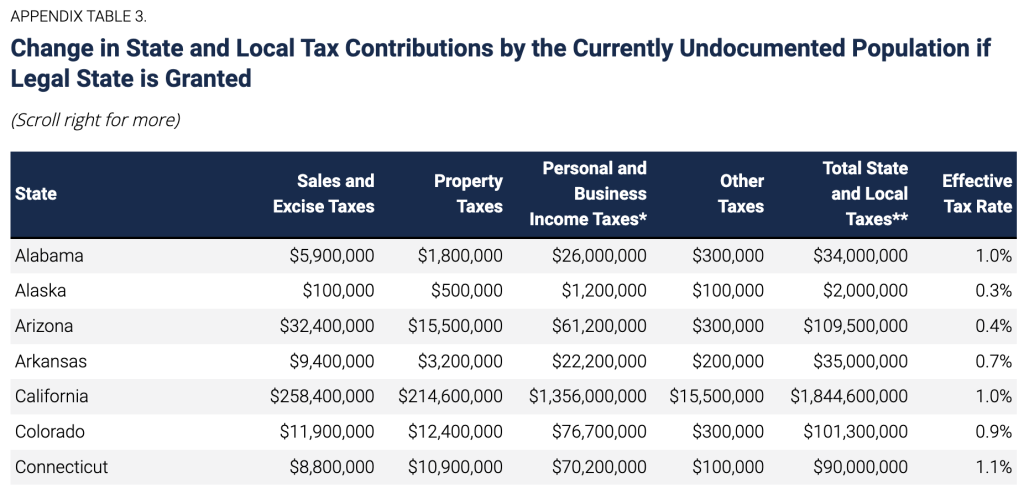

The study further estimates that, if these illegals were given citizenship, another $90,000,000 would allegedly be collected in taxes. This is based on yet another assumption that if given legal status, these workers would receive a 10% raise and that more of them would start paying taxes.

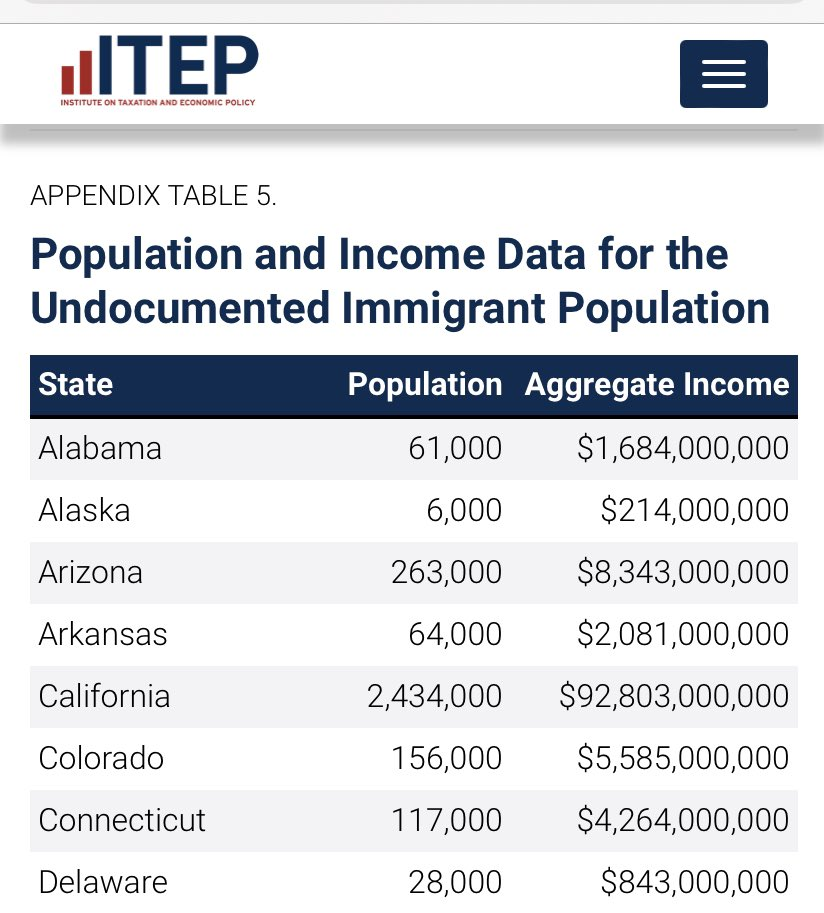

According to ITEP, Connecticut has around 117,000 illegals living in the state with an average annual salary of about $36,444. The ITEP study also alleges that illegal immigrants paid an average of $8,889 in federal, state, and local taxes per person in 2022.

If we are to assume that illegals in Connecticut also paid an average of $8,889 each and the state took in $406,400,000 as ITEP estimates, then that implies just 45,179 illegals allegedly paid taxes.

How many of the 117,000 illegals in Connecticut are getting government handouts and freebies, like free Husky Insurance, for instance?

How many are getting housing, rent and transportation assistance?

Is it just a coincidence that the mainstream media is reporting Connecticut has shortage of 92,000 affordable homes for low-income individuals and families?

How many are receiving assistance for food and legal costs?

What about scholarships, financial aid, and other assistance for college-bound illegals?

Did you realize that Connecticut offers drivers licenses to illegals?

What is the total expense to legitimate Connecticut taxpayers for all of these programs for illegals?

Well, according to the case study on mass immigration that the Center for Immigration Studies (CIS) just published on July 25, 2024, about Massachusetts, illegal immigration is a net burden on taxpayers:

On average, illegal immigrants pay less in taxes than they consume in welfare benefits and other social services. This is primarily because on average illegal immigrants have relatively low levels of education compared to Americans, which generally consigns them to working in lower-paying jobs. More than two-thirds of adult illegal immigrants have no education beyond high school, compared to 35 percent of native-born Americans. Moreover, many illegal immigrants work “off the books”, without income taxes withheld.

CIS has estimated that the cost of these benefits on the national level is $42 billion, or 4 percent of the total cost of these programs. CIS has also estimated a lower tax contribution by illegals than ITEP has.

In 2019, for example, CIS estimates that 12.8 million illegals paid about $26 billion to the federal government, including $6 billion in federal income tax, $16.2 billion in Social Security taxes, and $3.8 billion in Medicaid taxes.

That's quite a bit different than the conclusion reached by the ITEP study published on July 30, 2024, which estimated that 10.9 million illegals paid $59.4 billion to the federal government.

The CIS study further estimates that, on average, there is a lifetime net fiscal cost to American taxpayers of $68,000 for each illegal alien.

So if we use ITEP's estimate of 117,000 illegals living in Connecticut, it suggests a lifetime net fiscal cost of $7,963,540,000 to Connecticut taxpayers.

Democrats and their spokespuppets will gaslight Connecticut into thinking it’s great that we’re getting all these taxes from illegal immigrants. The REALITY is that illegals are transforming our state into an economic zone, not a nation for citizens. Himes has spent 16 years in congress voting to keep the Border Door open. I will do everything possible to CLOSE IT! I'd be honored with your vote in the Aug. 13th Primary. bobmacforcongress.com