Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

Debt is defined as the state of owing money. Debt for many has become a lifestyle. Although there are times in human life where incurring debt may be necessary, vast amounts of personal debt are incurred as the result of bad choices or purchases based on desire and not critical need. The Holy Scriptures tell us that debtors are slaves to their creditors and the creditor becomes the master of the debtor. And this is a terrible situation to be in.

If you do not believe that, just ask any debtor.

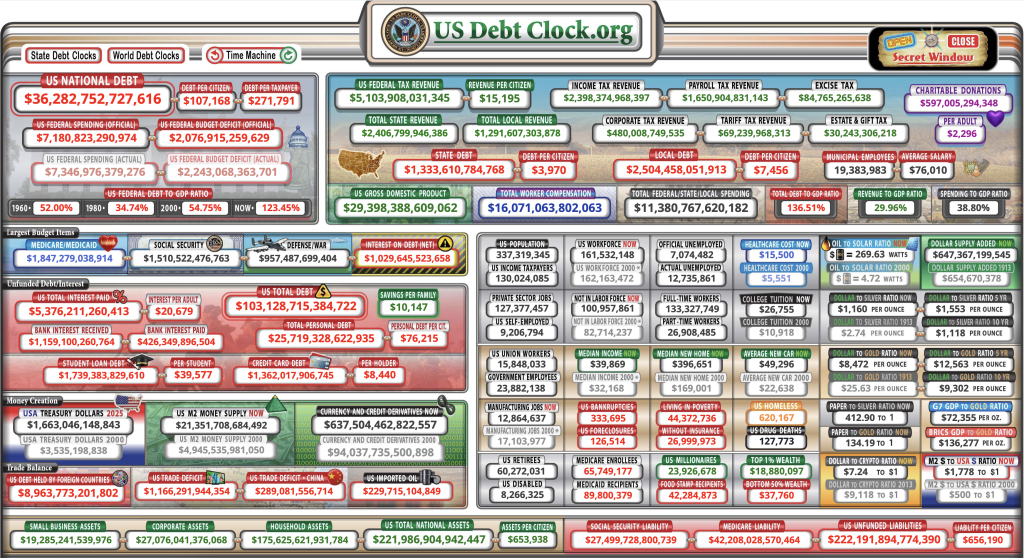

The American citizen understands there are several types of debt in our economy. We have consumer debt which can be broken down into various categories such mortgage debt, auto loan debt, credit card debt, higher education loan debt and personal loan and credit line debt. The figures for these types of debts astonish many. Here are some for you to ponder from the third quarter, 2024:

Household debt, based as a percentage of disposable income as a debt payment-to-income ratio from the second quarter of 2024, is 11.5%. Or in other words, 11.5 cents of each dollar of disposable income goes to service debt. The other 88.5 cents of each dollar you clear is what you would have to pay all your other expenses.

One may think that a government, with all its collective wisdom, would be able to fund its operations without debt. Unfortunately, the opposite is true. Government at all levels, be it local, state, or national, is massively in debt. The Federal National Debt is $36.2 trillion dollars and rising. For 2024, the Federal Government will spend a mere $892 billion dollars to finance its National Debt. State governments such as Connecticut have $150 billion dollars in short- and long-term debt and unfunded liabilities that are never tackled or confronted by the superficial, feel-good “bi-partisan” political Uniparty, and this happens elsewhere, as well. If one were to add the total state debt of all fifty states, you are looking at $1.7 to $2 trillion dollars in debt depending on published figures and unfunded liabilities. Municipal Debt, which is funded by municipal bonds, is roughly $4 trillion dollars.

If one were to add up Total American Household and Government Debt, it is approximately $58 trillion dollars in total. Is there any plan to pay off the Government debt at all levels, local, state, and national? Not to my knowledge. In fact, the opposite is true. U.S. Senator Ron Paul released his annual “Festivus” report describing the horrific if not obscene wastes in left-inspired government spending. The Connecticut of King Governor Ned Lamont The Unaccountable pays no attention to fiscal wreckage and pilfering by state university officials and aides while anti-business capitol city Hartford is watching its tallest office building fall into foreclosure on the way to capitulating into subsidized low-income housing.

The iconic Chrysler Building in midtown Manhattan New York, one of the most historically desirable business locations in days gone by, is facing foreclosure in a rotting and violent New York City. Obviously some states and municipalities are in much better shape financially than others especially Democrat led and poorly governed states like Connecticut and New York where commercial taxpaying businesses leave so as not to continue to fund policies of woke nonsense, DEI programs, unchecked illegal immigration, high crime, and higher and higher taxes paid to the inept and illogical Blue State governments burning cash more quickly than their infrastructures and economies are deteriorating.

But in review of this sordid and sick situation, one has to conclude that if debtors are slaves to creditors, Blue State Democrat politicians love to increase debt and redundancy while increasing the enslavement of citizens by tossing them fictional “bones” and freebies that the fewer remaining legitimate and taxpaying citizens must bear the burdens of paying via increased taxes and fees.

The worst examples of this reckless and unregulated spending are in education and medicine, where the philosophy has been that more spending, redundant administration, and taxes will continually solve problems when all of this drives costs and debts to astronomical levels that are impossible for debtors to ever pay. However, in Connecticut and other Blue States, your Democrat politicians, such as The Unaccountable and his henchmen, will create “medical debt forgiveness” causing such egregious debt to magically disappear overnight with a legally questionable program.

In Connecticut, it is reported that 23,000 residents (citizenship optional) will have $30 million debt in debt wiped out! My good friend and colleague Tony De Angelo sharply questioned the legality of this program in detail which is apparently run by "Undue Medical Debt" on his weekly segment on the Lee Elci show 94.9, this being a strange charitable organization for contributions that can be channeled to various locales for the ostensible buying of votes and political influence. This "loan forgiveness" program has several legal questions that need to be answered clearly and transparently for Taxpayers, but we know it will not be. Because, the Democrat Master is calling the shots! (You see? The Master increased your debt. The Master is now coming to relieve your debt with his signature on the debt forgiveness letter! To show your appreciation, always vote for The Master as he creates more bulbous debts to charitably relieve for others. Be advised, The Master, has spoken.).

Contrary to what our elected officials and credit companies tell us, our current collective level of debt is not sustainable. It will be quite painful to see what economic damages consumers and governments will be dealing with in 2025, especially with the amount of interest that will be paid to finance $58 trillion dollars in debt. Where does this money come from? Just more and higher taxes on a government level? On a personal level the elimination of one meal a day and or homelessness or broken families or foreclosure? Perhaps our economy, especially our government, could learn to do much more with less and pay down this sickening economic albatross that strangles our economic system for generations to come. Then again maybe they could care less about it since political power means economic power in our not so brave new world as more slaves are created for their avaricious and corrupt masters.