Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

Fiscally conservative policy is about low taxes, reduced government spending, free markets, limited regulation, free trade, and minimal government debt. Fiscal conservatism follows the same philosophical outlook as traditional liberalism which advocates for economic freedom along with freedom of speech and political freedom from unnecessary regulation of social issues.

So, does Greenwich follow fiscal conservatism? Based on our taxes, the answer is clearly “no.” Greenwich Taxes have NEVER gone down, and the tax increases have exceeded inflation by an average of 2.3% per year. Put another way, the tax rate grew 77% faster than inflation as seen in the slope of the trend lines below. There has not been a single year in which the Town tax levy has decreased, not even during the worst part of the financial crisis. Even when total expenditures went down, taxes went up. This despite a nearly flat population and flat to declining school enrollment.

These tax increases are also NOT the result of new services or significant improvements.

During the late 1990s and early 2000s, tax increases were offset by increases in property values. However, since 2006 this has not been the case and property appreciation in Greenwich has significantly lagged inflation and the nation.

Much of the capital spending since 2006 has been extravagant: A huge police & fire complex downtown, a huge high school auditorium that is never fully utilized, an oversized school in the name of diversity, and now oversized middle school and a hugely expensive and large renovation.

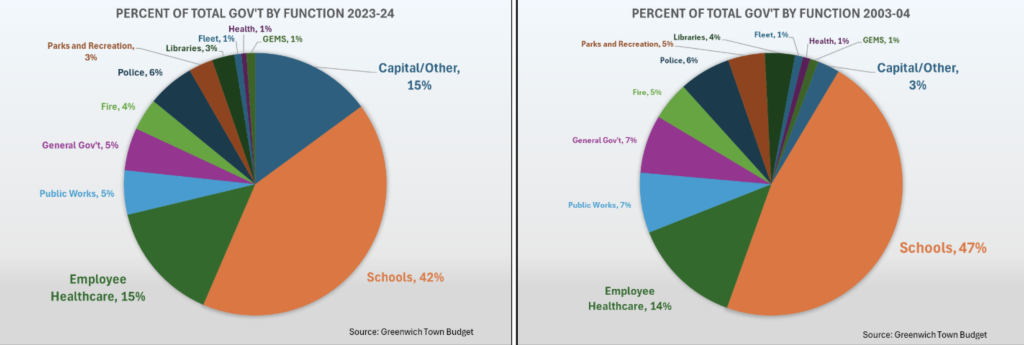

The one saving grace has been that Greenwich has a fixed debt limit. But this debt is maxed out and under pressure from Democrats. The Charts below show the pressure that increased and unnecessary capital spending is putting on our budget. Capital spending is up from 3% to 15%, as healthcare costs have skyrocketed. As a result, school budgets are squeezed from both ends – demands for more capital spending and huge pay raises for town employees and rising healthcare costs.

But if taxes continue to rise, the debt limit is likely to fall. That will help keep taxes in check by pushing the tax burden out a few years, but property values will decline because property values are pushed down by high taxes and high debt.

For many years, the Republican establishment has been running on the idea that they must raise taxes to keep their seats. That excuse has played out. Homeowners are the losers and homeowners are the voters.

The situation is no better when it comes to big government and excessive regulations. Since Indivisible Greenwich and March On came to town we have seen a “anti-oil and gas” regulation added, and a local plastic bag ordinance though there were state regulations already in place for the same; Greenwich created a housing trust, a rent “fairness” committee, a blight board in addition to the existing “Nuisance board”; and most recently a ban on gas leaf blowers. We have also seen an explosion in “advisory committees,” opining on everything from Disabilities and Energy to Speech.

If you are a homeowner and your investment in your home is not negligible or if you consider yourself fiscally conservative, you should be focused on trying to keep this uncontrolled and useless growth in our taxes and government in check.

More “nonsense” from Spilo? No way! This is a great summary of the erosion of the Greenwich I grew up in, and I wish this sort of view point was considered more “common sense”, especially when most households have to operate with fiscal responsibility in mind. One more note, since a staggering 1/3 of residents are renters, renters pay taxes through proxy of their landlords in the form of rent. So if renters want to help keep rent prices in check, please vote for fiscal responsibility.

Thank you Mike for a great analysis. Really appreciate you!