Please Follow us on Gab, Minds, Telegram, Rumble, Gettr, Truth Social, Twitter

No doubt, many of us, if not all of us, do not enjoy paying state and federal taxes. Unfortunately, it’s a yearly undertaking to file and pay up. If you’re fortunate enough, you may get some of YOUR hard earned money back in the form of a refund.

As you are well aware, our taxes are used to fund the state and federal governments, wars, our military, federal employees, various programs, politician salaries, etc. It appears our tax revenue is thrown into a deep black hole never to be seen again and our local, state and federal taxes inevitably go up. To bring it closer to home, the Greenwich mill rate will be going up 2.8% with the colossal budget passed by the RTM, the town's legislative body, recently.

Our taxes are now paying for student loans.

Yes, WE are now the proud taxpayers who will have to pay back loans for students we have never met, nor do we even know what schools they attended or what degrees were earned. The burden of responsibility has been shifted to responsible, productive and hard working citizens. In other words, ALL taxpayers are now in the loan repayment business with absolutely no benefit to us, the taxpayers. The ONLY individuals that benefit are the students or former students that took on loans they couldn’t afford and now expect those loans to be forgiven. Economists estimate student loans to surpass $1.7 trillion.

“Forgiven” is just a fancy term for shifting the burden. Someone has to pay these loans back. President Joe Biden (D), during his 2020 campaign, pledged to forgive these student loans and is attempting to keep this campaign promise by ignoring a decision by the U.S. Supreme Court and instead issuing Executive Orders.

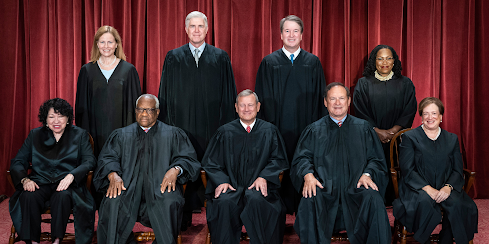

SCOTUS recently struck down student loan forgiveness in a ruling made in Biden vs. Nebraska that has left many American students disappointed. The Biden Administration aimed to forgive a portion of student loan debt for borrowers in the amount of $400 billion for students who claim to have been misled by their colleges. This decision has brought to light the complexity and controversy surrounding student loan forgiveness in the United States.

One of the main arguments against student loan forgiveness is that it would create a moral issue by encouraging individuals to take on more debt than they can afford. Critics argue that forgiving student loans would not only be unfair to those who have already paid off their debts, but also incentivize irresponsible borrowing behavior in the future. This concern has been a major factor in the Supreme Court's decision to reject the proposal.

Another argument against student loan forgiveness is the potential economic impact it could have on the country. Some economists argue that forgiving student loan debt could lead to inflation and instability in the financial markets. Additionally, there are concerns about the long-term effects of such a policy on the overall economy.

Supporters of student loan forgiveness argue that it would help to level the playing field for individuals who were misled by their colleges. Many students were promised lucrative careers and high-paying jobs upon graduation, only to find themselves burdened with insurmountable debt and limited job prospects. Forgiving their loans would provide these individuals with a fresh start and a chance to rebuild their financial futures. Despite these arguments, the Supreme Court's rejection of student loan forgiveness is the right decision.

Notably and perhaps most importantly, the Supreme Court raised a valid Constitutional question: by what authority and power does the Secretary of Education have to forgive student loans? In its decision, the Supreme Court ruled that Secretary of Education Miguel Cardona does not have that Constitutional power and that such powers rests with Congress.

However, as noted previously, the Biden Administration has bypassed SCOTUS’ decision by issuing Executive Orders.

In case you were wondering, over 13,000 students in Connecticut will see their student loan burdens shifted to taxpayers as Greenwich Time points out in this article.

Responsibility comes in many forms. Taxpayers shouldn’t be responsible for poor decisions made by others. Imagine future loans these students may take out in the future such as car loans, mortgages and personal loans. Will taxpayers have to bail them out too? Where does this stop?

This country was built on capitalism, not socialism.

Do you know which elected officials condone this tax burden?

Sources:

Supreme Court strikes down Biden student-loan forgiveness program

Supreme Court Strikes Down Student Loan Forgiveness Program